All aspects of family law can be complicated.

All aspects of family law can be complicated.

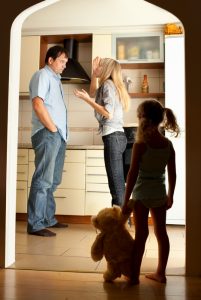

Divorce, even when it’s decided upon mutually by a couple, is a complex process that involves separating two deeply connected lives. In many cases, divorce doesn’t just affect the spouses involved, but the children that came from the marriage too.

When children are involved in a family law case, the number of issues to be addressed increases significantly. Not only do you need to consider equitable distribution, and spousal maintenance, but you may need to consider child custody and child support too.

This bullet point guide on child support aims to address some of the issues that parties encounter during a divorce and child support case. In this segment, we’ll be looking at what happens when a child support order is violated, and when orders can be modified. Continue reading ›

Long Island Family Law and Mediation Blog

Long Island Family Law and Mediation Blog

Welcome back to this continued series of bullet-point guides on Child Support. If you’ve seen one of these guides before, you’ll know that it’s my way of bringing together useful information, that I have covered in more depth articles over the years, about a topic in family law, in a way that’s easy to absorb. These guides can offer valuable insights to anyone who might be pursuing family law or divorce cases.

Welcome back to this continued series of bullet-point guides on Child Support. If you’ve seen one of these guides before, you’ll know that it’s my way of bringing together useful information, that I have covered in more depth articles over the years, about a topic in family law, in a way that’s easy to absorb. These guides can offer valuable insights to anyone who might be pursuing family law or divorce cases. Over the recent months, I’ve been working on various guides and bullet-point lists of facts and insights for people interested in learning more about the various complications of divorce litigation, divorce mediation, child custody cases and most recently child support matters. This guide explores the basics of child support, one of the most important payments to be determined when two parents get a divorce, live apart, or separate.

Over the recent months, I’ve been working on various guides and bullet-point lists of facts and insights for people interested in learning more about the various complications of divorce litigation, divorce mediation, child custody cases and most recently child support matters. This guide explores the basics of child support, one of the most important payments to be determined when two parents get a divorce, live apart, or separate. Welcome back to another section of my recent guide about child support in family law and divorce cases. As you may well know, child support is a common concern for many parents, unmarried parents or those moving through a period of separation or divorce. It’s often important for the courts to determine how financial support should be issued to a child and their parent for the continued support of the children.

Welcome back to another section of my recent guide about child support in family law and divorce cases. As you may well know, child support is a common concern for many parents, unmarried parents or those moving through a period of separation or divorce. It’s often important for the courts to determine how financial support should be issued to a child and their parent for the continued support of the children. Thank you for once again joining me for another instalment in this bullet-point guide on child support in family law. I’ve been using this bullet point series to try my best provide parties interested in family law and the decisions that need to be made by the court or people embroiled in these cases, with valuable information.

Thank you for once again joining me for another instalment in this bullet-point guide on child support in family law. I’ve been using this bullet point series to try my best provide parties interested in family law and the decisions that need to be made by the court or people embroiled in these cases, with valuable information. If you are a regular visitor to my blog, you may have noticed that alongside my regular articles and blog posts, I have also been introducing a series of bullet-point guides. These guides are intended to curate some of the more complicated ideas addressed in my other articles, into something that is a little easier to consume in bite-sized chunks.

If you are a regular visitor to my blog, you may have noticed that alongside my regular articles and blog posts, I have also been introducing a series of bullet-point guides. These guides are intended to curate some of the more complicated ideas addressed in my other articles, into something that is a little easier to consume in bite-sized chunks. For some time now, I’ve been using this blog as an opportunity to share valuable information about family law, child custody, and divorce with people who need guidance. With many years of experience working as a child support attorney and divorce lawyer in New York, I’ve answered a lot of questions in my time.

For some time now, I’ve been using this blog as an opportunity to share valuable information about family law, child custody, and divorce with people who need guidance. With many years of experience working as a child support attorney and divorce lawyer in New York, I’ve answered a lot of questions in my time. Throughout the past year, I’ve been publishing a series of guides intended to support anyone who wants to learn more about the common issues that emerge in family law and divorce cases. This particular guide is a continuation of the Child Support series.

Throughout the past year, I’ve been publishing a series of guides intended to support anyone who wants to learn more about the common issues that emerge in family law and divorce cases. This particular guide is a continuation of the Child Support series. If you’ve been following this blog for a while now, you’ll know that I have been producing a series of bullet-point guides that cover various common topics associated with divorce, family law, child custody, and similar concerns.

If you’ve been following this blog for a while now, you’ll know that I have been producing a series of bullet-point guides that cover various common topics associated with divorce, family law, child custody, and similar concerns. For everyone’s information we are still doing business and trying our best to help people during this crisis. In difficult times such as the COVID-19 pandemic, we all still have issues that we need to face in our personal lives, such as dealing with child support and maintenance awards. The default law around child support modification indicates that either party in a case can file for a modification of child support based on:

For everyone’s information we are still doing business and trying our best to help people during this crisis. In difficult times such as the COVID-19 pandemic, we all still have issues that we need to face in our personal lives, such as dealing with child support and maintenance awards. The default law around child support modification indicates that either party in a case can file for a modification of child support based on: